Investment Management

Investing doesn't have to be complicated, focus on the simplicity of successful investing...

In this day and age, investors are inundated with investment information. It’s difficult not to be alarmed by some of today’s business headlines. It is a daunting task to build an investment portfolio from scratch. At Niagara Wealth, we work with you to build and maintain a well-balanced, diversified portfolio that will help you reach your long-term goals at a level of risk that is acceptable to you. You will have peace of mind just knowing that you have someone to help you navigate today’s volatile financial markets.

Many Canadians are feeling confused by today’s investment climate. There are thousands of financial products available with different degrees of complexity. Knowing where and when to invest can seem overwhelming. However, making the most of your money still boils down to a few essentials:

- Reduce the impact of taxes

- Diversify to manage risk

- Invest long term

One of the most effective ways to increase your investment returns is to decrease the amount of taxes that you pay on the returns. In fact, studies indicate that creating a tax-efficient portfolio has one of the greatest impacts on creating wealth. At Niagara Wealth, we can help you take advantage of all the opportunities the world has to offer while minimizing the tax that you pay. One of the easiest ways to minimize tax is by maximizing the investment within a tax-deferred environment, such as a Registered Retired Savings Plan (RRSP), where your investments can grow sheltered from tax.

When investing outside a registered plan, it is important to focus on investments that generate capital gains or dividend income as they’re both taxed more favorably than interest income.

There are other strategies that can be utilized depending on your personal financial circumstance. Contact Niagara Wealth to learn how we can create a tax-efficient investment portfolio for you.

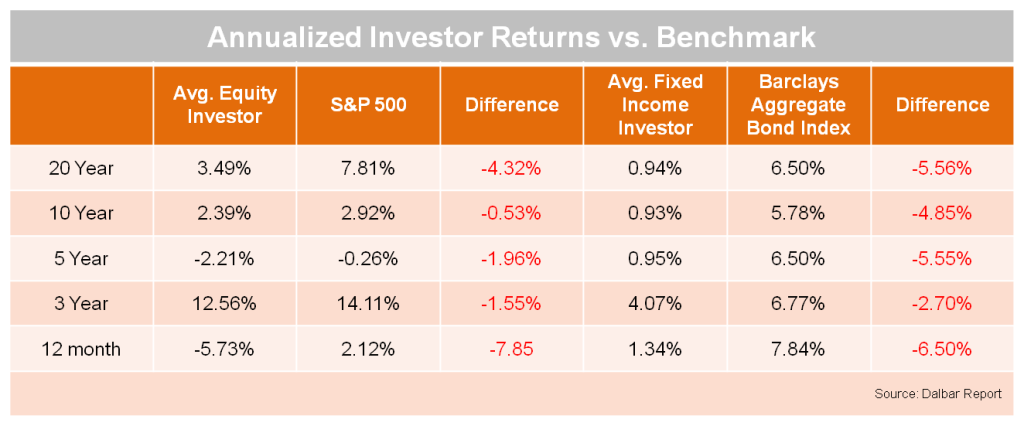

The ups and downs of financial markets can be unsettling. Many investors make the mistake of overacting in volatile markets jeopardizing a sound investment strategy. Keeping your emotions in check is very important. Many studies illustrate the dangerous of making hasty decision. One such study, the Dalbar report compares the historical performance of average investors versus a benchmark. The results are startling…

The table below shows the 1, 3, 5, 10 and 20 year annualized returns (ending December 31, 2011) for the average equity and fixed income investor. When comparing these annualized returns to corresponding benchmarks we see that both equity and fixed income mutual fund investors underperformed the market for every time frame.

So why do average investors continue to buy and sell at precisely the wrong time?

There are a number of possible explanations. They react to news – positive or negative – without careful analysis. They try to match the results of friends, neighbors, and even random strangers who claim to have done well with an investment.

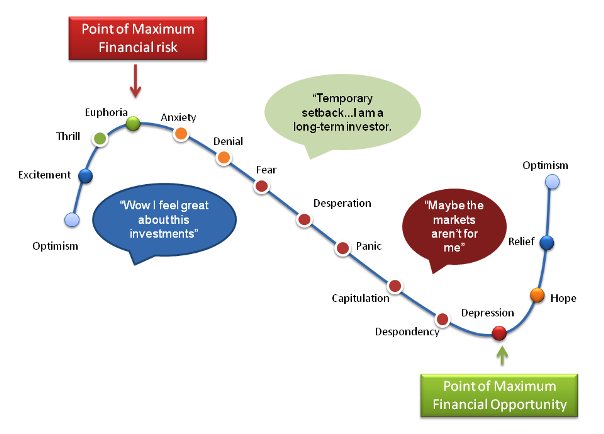

The chart above illustrates the cycle of market emotions you may feel as you track the performance of your investments through market ups and downs. Not surprisingly, it is very easy to feel great when your investments are performing well and feel anxious when they are down in value. While these are natural feelings, some actions you might consider may not be logical when you take into consideration your long-term financial plan.

The chart above illustrates the cycle of market emotions you may feel as you track the performance of your investments through market ups and downs. Not surprisingly, it is very easy to feel great when your investments are performing well and feel anxious when they are down in value. While these are natural feelings, some actions you might consider may not be logical when you take into consideration your long-term financial plan.

The reality is that seeing beyond the day-to-day fluctuations in the markets is the best way to reach your financial goals. This strategy is particularly important in today’s investment climate, where market volatility has become a fact of life.

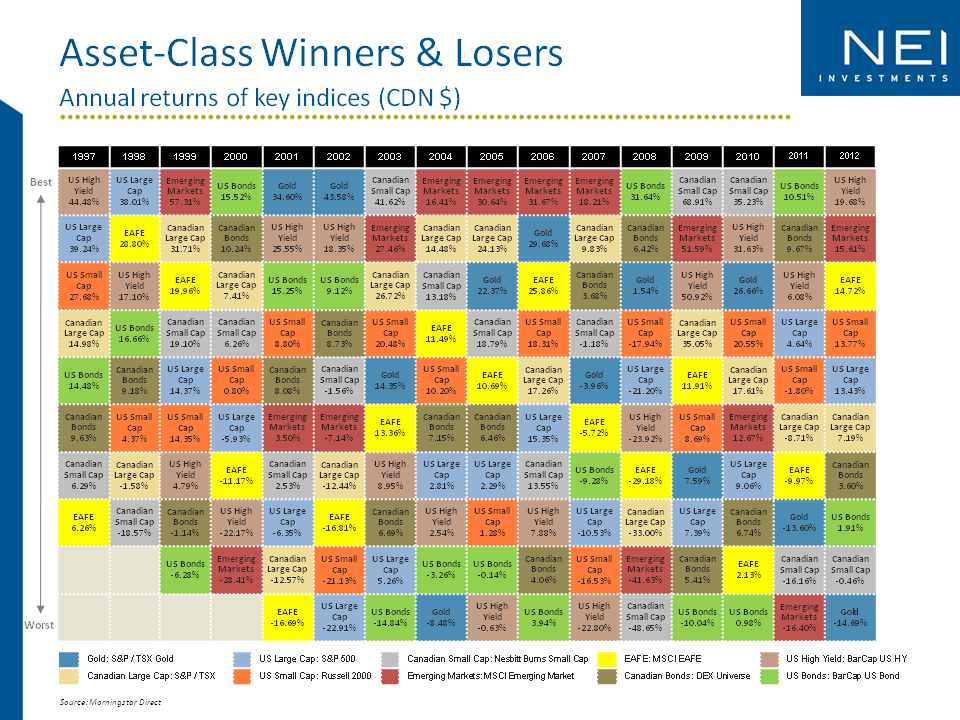

Why is a diversified portfolio so important? Quite simply it is the best way to increase potential returns over the long term and reduce the effects of market volatility.

Holding a mix of asset classes ensures that your portfolio takes part in the best-performing areas of the market. For broad exposure, your assets should include stocks and bonds spread across domestic and international markets. At Niagara Wealth, we will work together to determine the best asset mix based on your personal goals and risk tolerance.

At Niagara Wealth, we recognize that having a sound investment strategy is only part of a solution to create a customized financial plan. Contact us today to get started.